Discuss Which Monetary Policy Is Used Most Often and Why

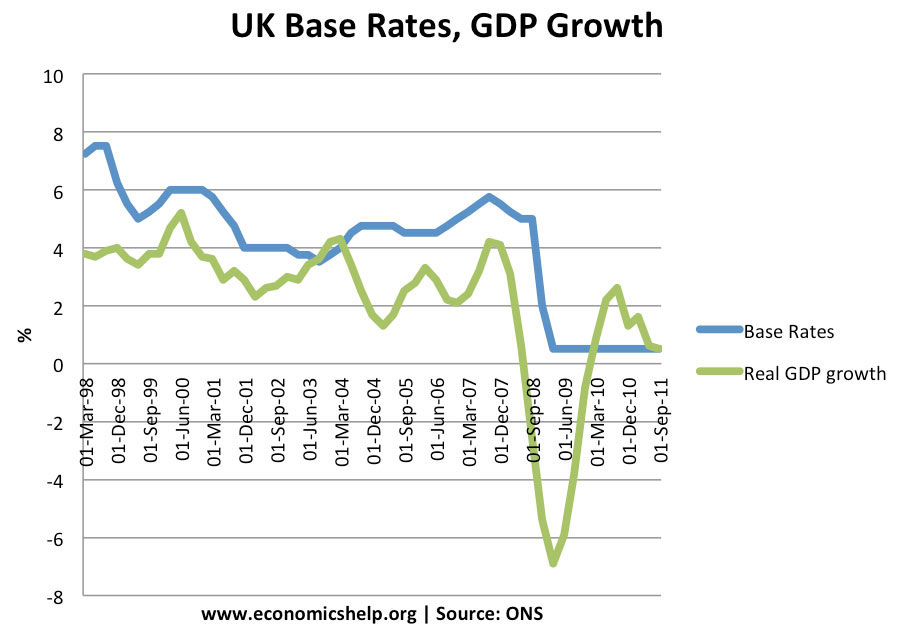

Broadly speaking monetary policy is either expansionary or contractionary. The most commonly used tool of monetary policy in the US.

28 4 Monetary Policy And Economic Outcomes Principles Of Economics

Is open market operations.

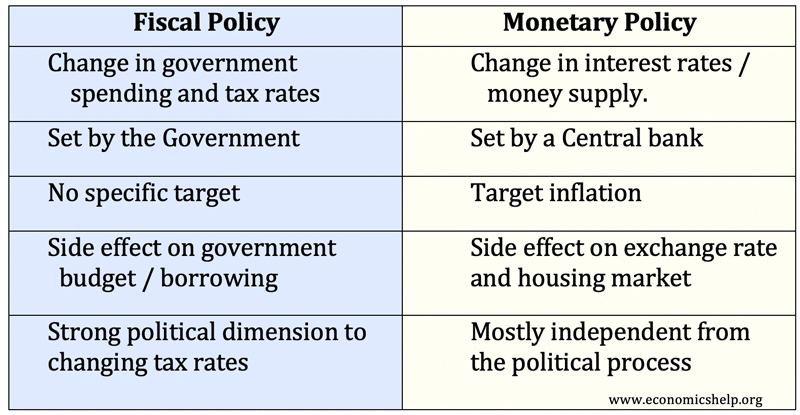

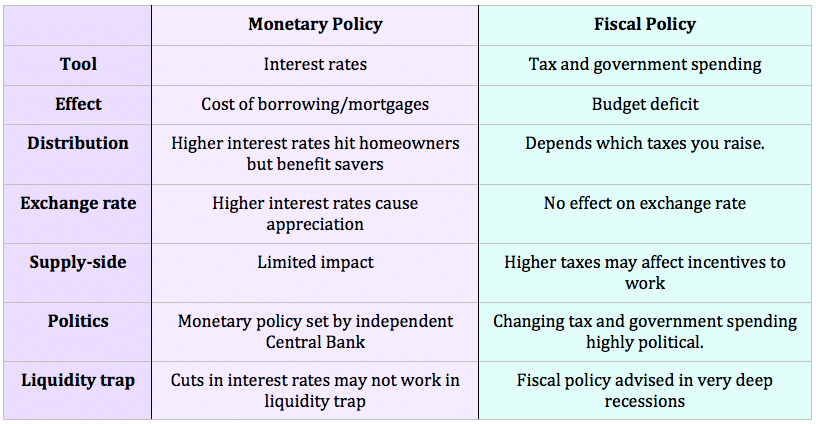

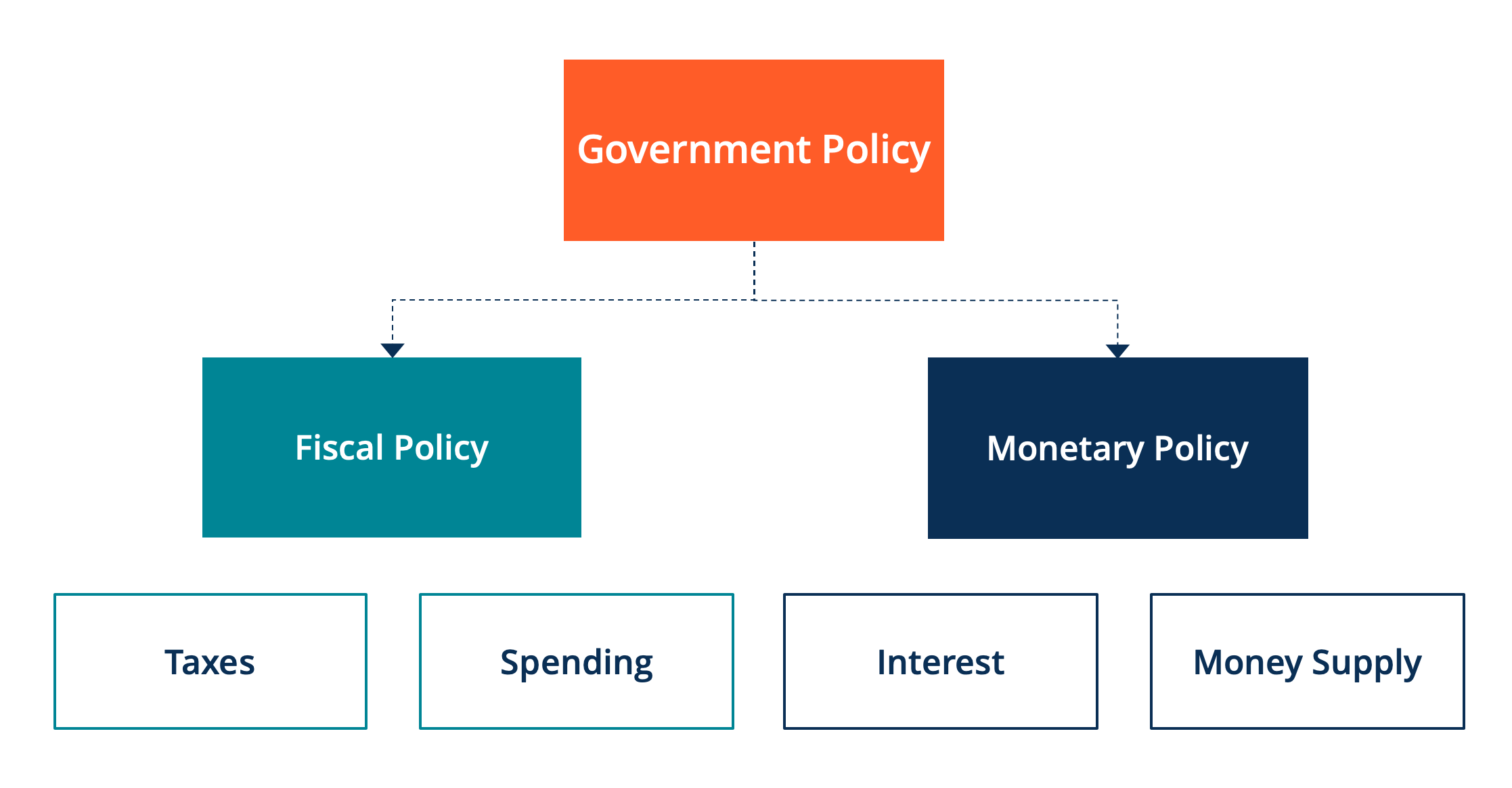

. The reserve requirement open market operations the discount rate and interest on reserves. Fiscal policy refers to the tax and spending policies of a nations government. Most central banks also have a lot more tools at their disposal.

The percentage of deposits that the Fed requires banks to keep on hand to cover customer withdrawals. Aggregate demand and US. Note that monetary policy is different from fiscal policy.

Use current APA formatting to. Define the term monetary policy tools. It is the tool the Fed uses MOST often.

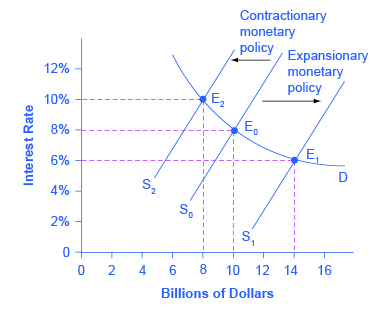

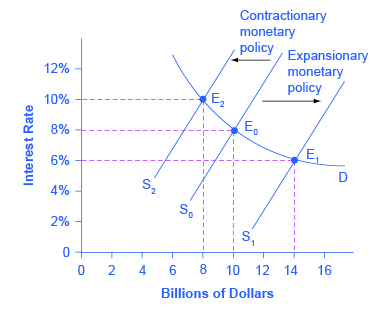

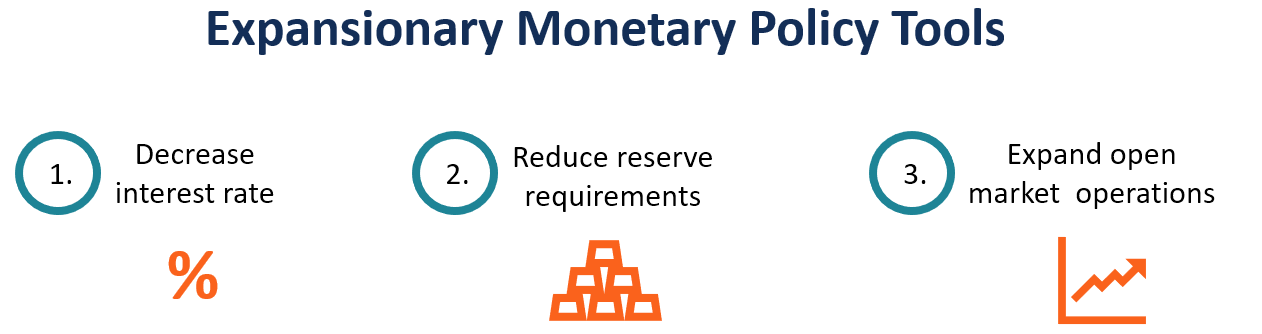

Monetary Policy Strategies in. Monetary policy is a term used to describe a set of tools that can be used to control the money supply. Open market operations are flexible and thus the most frequently used tool of monetary policy.

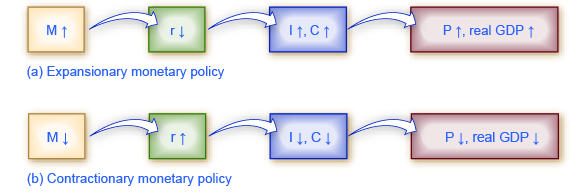

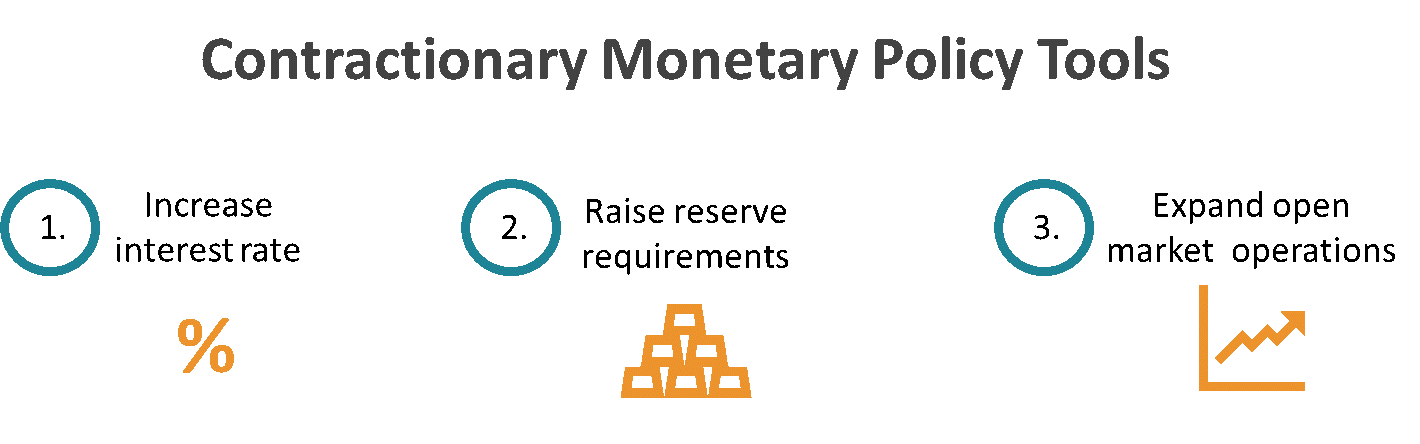

Because the United States economy has experienced its highest point in the last decade the 2010s monetary policy that cuts taxes and increased government spending in business and job-creation markets especially under former President Barack Obama has led to a decrease in the unemployment rate and a rapid increase in the United States GDP. Contractionary monetary policy is a strategy used by a nations central bank during booming growth periods to slow down the economy and control rising inflation. Monetary Policy Instruments Target and Goals 6 List of Figures Figure 1.

Provide an example of a real-life application in which the Federal Reserve Banking System would use contractionary monetary policy over expansionary monetary policy. Fiscal Policy Pros and Cons. Define the term monetary policy tools.

By contrast fiscal policy refers to the governments decisions about taxation and spending. Another key monetary policy tool deployed in response to the financial crisis was large-scale asset purchases which were purchases in securities markets over six years of roughly 37 trillion in longer-term Treasury securities as well as securities issued by government-sponsored enterprises. Explain how each monetary policy tool is used.

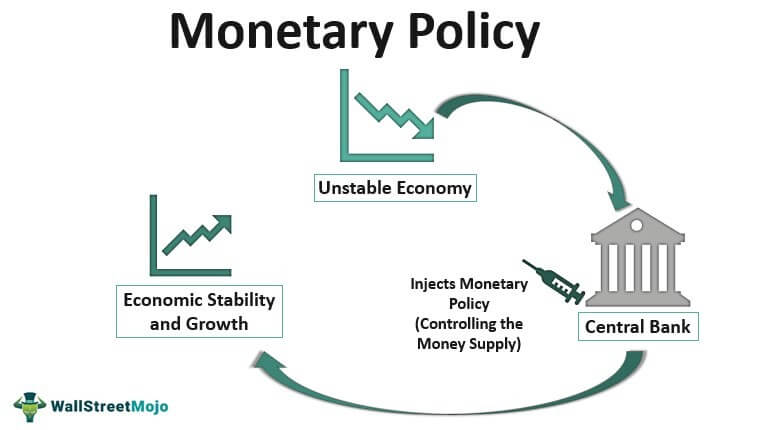

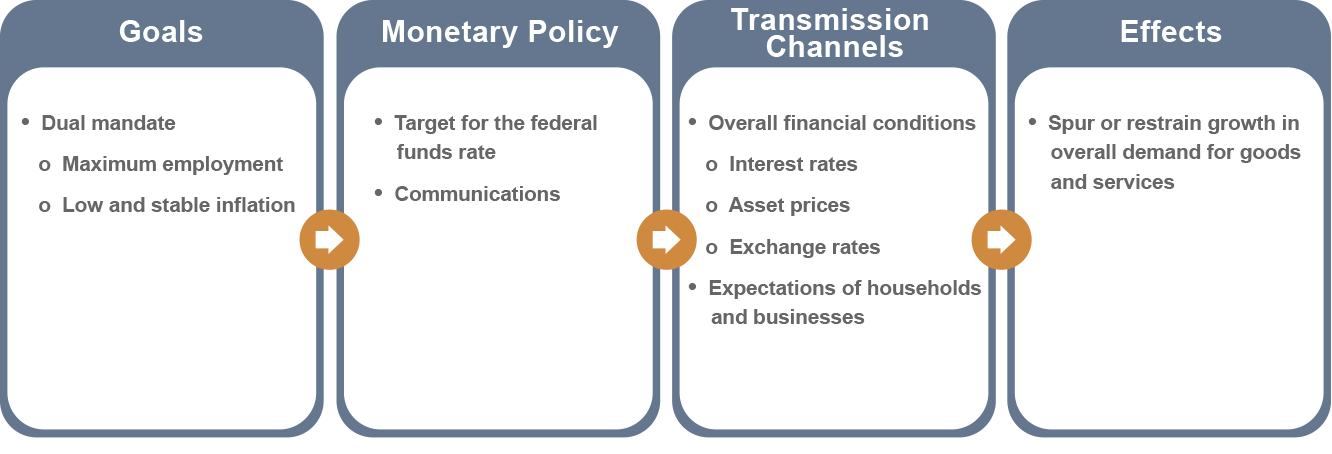

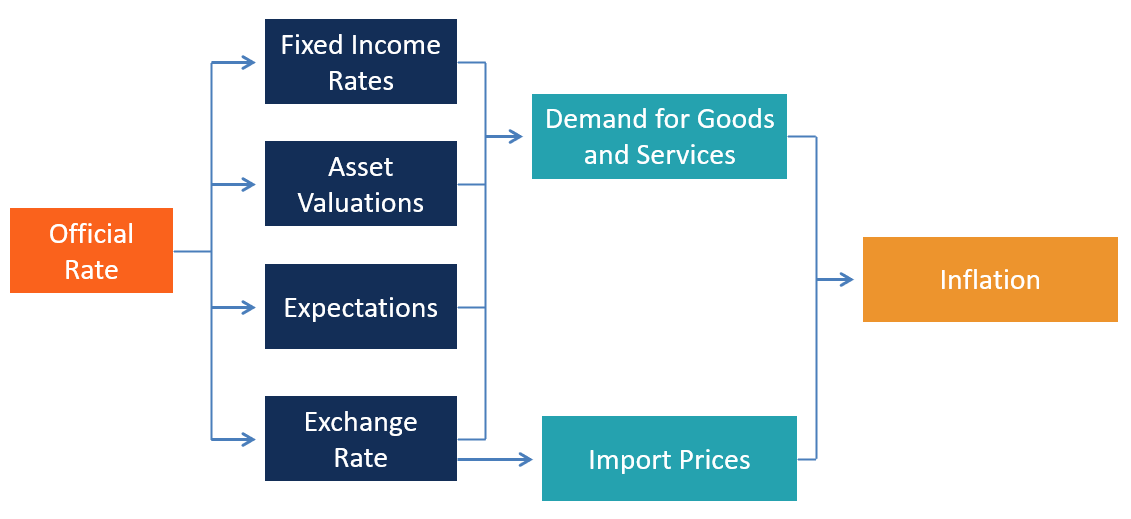

The specific interest rate targeted in open market operations is the federal funds rate. Monetary policy refers to central bank activities that are directed toward influencing the quantity of money and credit in an economy. Both monetary and fiscal policies are used to regulate economic activity over time.

Explain how each monetary policy tool is used. Discuss which monetary policy is used most often and why. The Fed buys and sells bonds on the open market.

Provide an example of a real-life application in which the Federal Reserve Banking System would use contractionary monetary policy over expansionary monetary policy. The Fed and the tools of monetary policy. I think that expansionary monetary policy will be used most often as Americans begin to supply more dollars on the foreign exchange market so that they can purchase foreign assets.

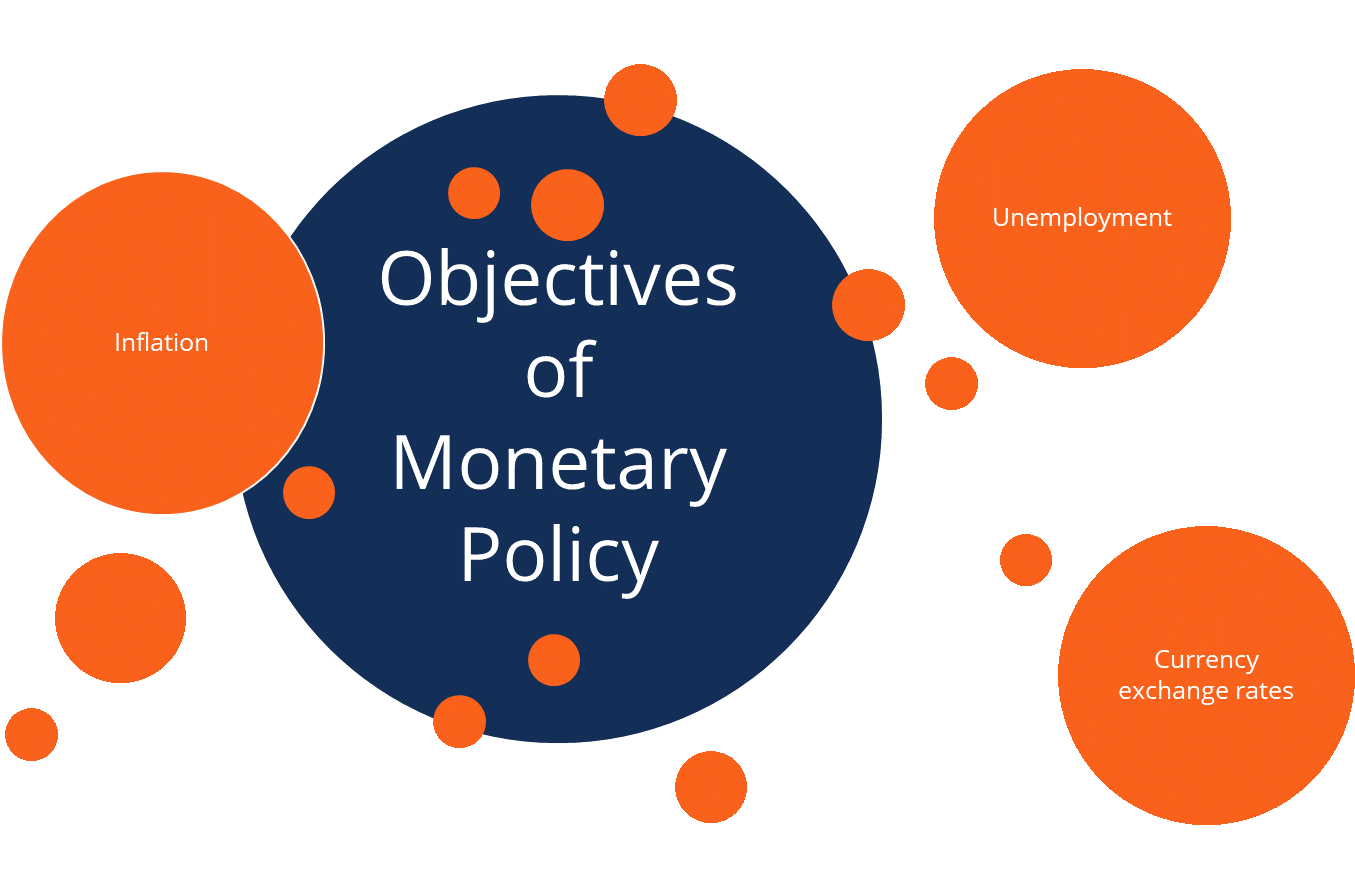

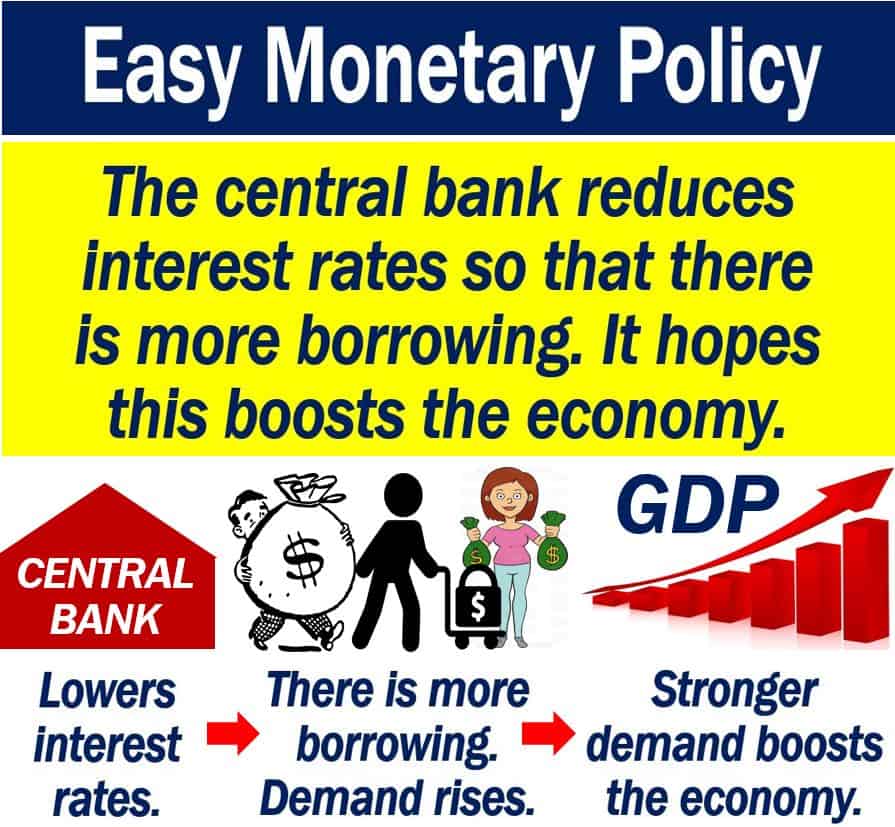

An expansionary policy aims to increase spending by businesses and consumers by making it cheaper to borrow. Summarize your findings using at least 250 words and provide a minimum of one reference. The Federal Reserve uses monetary policy to manage economic growth unemployment and inflation.

By boosting the overall demand for these securities the. Central banks have four main monetary policy tools. 1 It is one of the main economic policies used to stabilise business cycles.

The first tool of monetary policy is Open Market Operations which refer to the buying and selling of financial instruments by central banks. Dollar depreciation affects both US. It is primarily implemented by a nations central bank which in the United States is the Federal Reserve.

Provide an example of a real-life application in which the Federal Reserve Banking System would use contractionary monetary policy over expansionary monetary policy. The discount rate is the interest rate charged by Federal Reserve Banks to depository institutions on short-term loans. Discuss which monetary policy is used most often and why Summarize your findings using at least 250 words and provide a minimum of.

Major deterrent to bank panics. The Federal Reserve uses three main. It is the tool used LEAST often.

Fiscal policy affects tax rates and a nations budget and is enacted by. Discuss which monetary policy is used most often and why. Treasury bonds in order to influence the quantity of bank reserves and the level of interest rates.

It does this to influence production prices demand and employment. Provide an example of a real-life application in which the Federal Reserve Banking System would use contractionary monetary policy over expansionary monetary policy. 1How can the five major macroeconomic objectives be used to measure economic performance 2What is the future macroeconomic environment and its expected impact on management and the role of technology 3Which demandside policy monetary policy or fiscal policy should be implemented in order for a country to improve the strength of its currency.

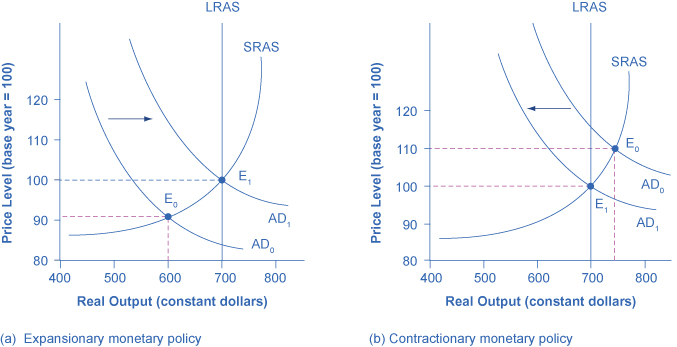

Expansionary monetary policy increases the growth of the economy while contractionary policy slows economic growth. A tight or restrictive fiscal. Discuss which monetary policy is used most often and why.

Open market operations take place when the central bank sells or buys US. Monetary policy is dictated by central banks. Economics questions and answers.

As the supply of dollars rises the dollar depreciates. Here are the four primary tools and how they work together to sustain healthy economic growth. 82 Monetary Policy and Inflation 22 83 Monetary Policy and Government Revenue 23 84 Monetary Policy Communication 24 85 Monetary Policy and You 25 86 Challenges to Monetary Policy in Nigeria 25 References 27 List of Tables Table 1.

The main three tools of monetary policy are open market operations reserve requirement and the discount rate. Explain how each monetary policy tool is used. In Australia monetary policy involves influencing interest rates to affect aggregate demand employment and inflation in the economy.

The Reserve Bank is responsible for monetary policy in Australia and it sets a target for the nations official interest rate which is referred to as the cash rate.

Monetary Policy Objectives Tools And Types Of Monetary Policies

Monetary And Fiscal Policy Video Khan Academy

Monetary Policy Objectives Roles And Instruments Upsc Indian Economy

Uk Monetary Policy Economics Help

Monetary Policy Definition Types Examples Tools

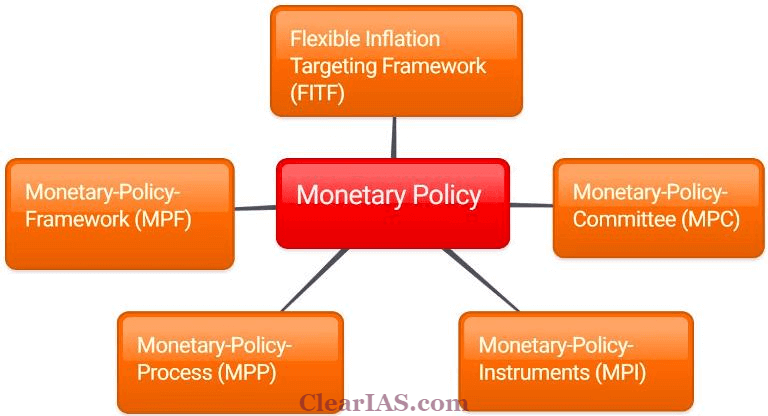

Monetary Policy Of India Everything You Should Know About Clear Ias

Difference Between Monetary And Fiscal Policy Economics Help

Federal Reserve Board Monetary Policy What Are Its Goals How Does It Work

Monetary Policy Vs Fiscal Policy Economics Help

What Is Easy Monetary Policy Definition And Example Market Business News

28 4 Monetary Policy And Economic Outcomes Principles Of Economics

Monetary Policy And Economic Outcomes Principles Of Economics 2e

3 Tools Of Monetary Policy Boycewire

Monetary Policy Vs Fiscal Policy Economics Help

Contractionary Monetary Policy Definition Tools And Effects

Monetary Transmission Mechanism Overview Central Bank Action

Expansionary Monetary Policy Definition Tools And Effects

Fiscal Policy Overview Of Budgetary Policy Of The Government

/GettyImages-520138826-72520152f6a74317b0b634ddeac6c59c.jpg)

Comments

Post a Comment